Pendampingan Koperasi Syariah Berbasis Mesjid Companiment of Mosque-Based Sharia Cooperatives

Main Article Content

Abstract

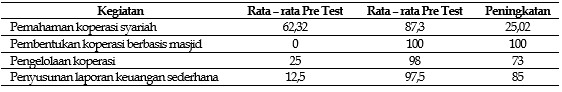

This community service aims to develop economic activities that focus on the establishment of a mosque-based cooperative in RW 08 Antaapani Wetan Village to introduce the community's sharia economy so that the economy becomes better. The minimum achievement indicator is having an understanding of the basics of Islamic economics. The target of establishing a mosque-based cooperative in RW 08 is the local Mosque Prosperity Council. The method used in this community service is using effective socialization methods to the community, training, and mentoring. The activities that will be carried out are empowering DKM by providing socialization, training, and mentoring for mosque-based cooperatives. Assistance is carried out until the end of the program implementation period and after the program ends.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Any article on the copyright is retained by the author(s).

- Author grant the journal, right of first publication with the work simultaneously licensed under a Creative Commons Attribution License that allows others to share work with acknowledgment of the work authors and initial publications in this journal.

- Authors are able to enter into a separate, additional contractual arrangements for non-exclusive distribution of published articles of work (eg, post-institutional repository) or publish it in a book, with acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their websites) prior to and during the submission process, as can lead to productive exchanges, as well as earlier and greater citation of published work.

- The article and any associated published material is distributed under the Creative Commons Attribution-ShareAlike 4.0 International License

References

Antonio, M. S. (2001). Bank syariah: Dari teori ke praktik. Gema Insani Press.

Arsyad. (2013). Koperasi syariah masjid mampu hilangkan rentenir. Republika Online. https://www.republika.co.id/berita/ekonomi/syariah-ekonomi/13/03/04/mj4eet-koperasi-syariah

Ascarya. (2016). Akad dan produk perbankan syariah. Rajawali Press.

Basid, A. (2009). Pemberdayaan ekonomi umat berbasis masjid (pengalaman BMT Masjid Nurul Jannah Petrokimia Gresik). Al-Qānūn, 12(1), 205–229.

Chapra, M. U. (2000). The future of economics: An Islamic perspective. The Islamic Foundation.

Dewan Syariah Nasional MUI. (2021). Fatwa DSN-MUI No. 141/DSN-MUI/VIII/2021 tentang Pedoman Pendirian dan Operasional Koperasi Syariah. https://drive.google.com/file/d/1-TR4Sjvz36Nc0ecZvTB_W_E0b4fm5vTZr/view

Gasperzs, J., Yulianti, R., & Simanjuntak, D. (2022). Peningkatan keterampilan penyusunan laporan keuangan UKM menggunakan aplikasi berbasis Android. Jurnal Pengabdian Kepada Masyarakat, 28(1), 44–49. https://doi.org/10.24114/jpkm.v28i1.33204

Hasyim, S. L. (2016). Strategi masjid dalam pemberdayaan ekonomi umat. Jurnal Lentera: Kajian Keagamaan, Keilmuan dan Teknologi, 15(2), 189–200.

Ismail, A. G. (2011). Introduction to Islamic banking and finance. Wiley.

Kardoyo, Hadi, S., & Nurkhin, A. (2018). Program peningkatan literasi keuangan syariah bagi guru Taman Pendidikan Al-Qur’an (TPQ) di Kota Semarang. Jurnal Pengabdian Kepada Masyarakat. https://jurnal.unimed.ac.id/2012/index.php/jpkm/article/view/10335

Karim, A. A. (2010). Ekonomi Islam: Suatu kajian kontemporer. Gema Insani.

Kementerian Agama. (2021). Sistem Informasi Masjid Seluruh Indonesia (SIMAS). Kementerian Agama RI.

Nina, S. A. T., & Pratama, V. Y. (2021). Analisis motivasi pinjaman nasabah pada rentenir berdasarkan prinsip pembiayaan syariah. Velocity: Journal of Sharia Finance and Banking, 1(1), 1–9. https://doi.org/10.28918/velocity.v1i1.3564

Pandapotan, P., & Soemitra, A. (2022). Studi literature strategi BMT dalam pemberdayaan ekonomi ummat berbasis masjid. El-Mal: Jurnal Kajian Ekonomi & Bisnis Islam, 3(3), 584–598. https://doi.org/10.47467/elmal.v3i3.941

Panjaitan, F. E., & N. (2018). Praktik pelepas uang/rentenir di Nagari Lubuk Basung Kabupaten Agam Sumatera Barat. Jurnal Buana, 2(1), 398. https://doi.org/10.24036/student.v2i1.89

Praktisi Perbankan Syariah dan Akademisi di UIN Sunan Kalijaga Yogyakarta. (2015). 5 langkah jitu membentuk koperasi syariah berbasis jamaah masjid. Kompasiana. https://www.kompasiana.com/daryoko/55965427d27a619413b13b4c

Obaidullah, M. (2008). Introduction to Islamic microfinance. IBF Net.

Srisusilawati, P., Pratomo, D. S., & Adam, P. (2021). The roles of self-efficacy and sharia financial literacy to SMEs performance: Business model as intermediate variable. F1000Research, 10, 1310. https://doi.org/10.12688/f1000research.76001.1

Srisusilawati, P., & Adam, P. (2017). The role of DPS in providing food product supervision on sharia tourism. International Conference on Islamic Business Law: Sharia Compliance.

Syahdan, H. S., & Ibnu, A. R. (2021). Penguatan kemandirian ekonomi masyarakat melalui pendirian lembaga keuangan mikro berbasis syariah di Desa Cianaga, Kabandungan, Jawa Barat. Almujtamae: Jurnal Pengabdian Masyarakat, 1(2), 65–69. https://doi.org/10.30997/almujtamae.v1i2.2915

Sudarsono, H. (2002). Bank dan lembaga keuangan syariah: Deskripsi dan ilustrasi. Ekonisia.

Wahyudi, S. T., Khusaini, M., & Pratomo, D. S. (2016). Pemberdayaan usaha mikro dan kecil (UMK) berbasis syariah: Studi pada program PUSYAR Badan Amil Zakat Nasional (BAZNAS) Kota Mojokerto. Jurnal Pengabdian Kepada Masyarakat, 22(3), 140–146. https://doi.org/10.24114/jpkm.v22i3.4781

Faktor-Faktor yang Mempengaruhi Masyarakat Berhubungan dengan Rentenir. (2020). Aghniya: Jurnal Ekonomi Islam, 2(2), 174–192. https://doi.org/10.30596/aghniya.v2i2.4837